MICRO CREDIT OR COMMUNITY LENDING SYSTEMS FOR RURAL MADAGASCAR

Most villages are in remote areas in Madagascar as poor

subsistence farmers, nobody is willing to lend them money for e.g. seeds,

life stock or tools, so they turned to Zahana for help. Word of mouth travels

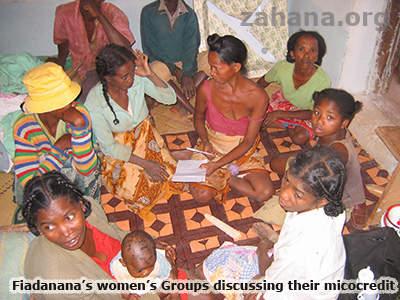

fast in rural areas as they had heard that Zahana launched a small

microcredit pilot project in Fiadanana in the fall of 2007.

Most villages are in remote areas in Madagascar as poor

subsistence farmers, nobody is willing to lend them money for e.g. seeds,

life stock or tools, so they turned to Zahana for help. Word of mouth travels

fast in rural areas as they had heard that Zahana launched a small

microcredit pilot project in Fiadanana in the fall of 2007.

What is micro credit?

It is Zahana's goal to create a community-based lending

system often referred to as micro credit, micro lending or micro enterprise.

In many communities where people live from subsistence agriculture, the

lack of access to cash for emergencies or purchasing goods or seeds is

a major obstacle for improving quality of life or overcoming poverty. Making

cash available to the community members at all, as well as for reasonable

rates, often for the first time, is a vital step to addressing this common

problem.

Micro credit or community lending systems have been used worldwide successfully for years by organizations such as the Grameen Bank in Bangladesh, SEED of Sarvodaya in Sri Lanka and bigger national or international schemes. In the last few years, microcredit programs have become the darlings of the development community and, while they are by no means a magic bullet, they are a step in the right direction. Some larger institutionalized microcredit systems are operating in Madagascar, but their interest rates are reported to be steep and they are currently not widely utilized in the communities where they would be needed the most.

How does microcredit work?

It is Zahana's philosophy that micro credit works best when it is community

run, administered and controlled. The closer the lender and the borrower

are to each other, the better a truly community run microcredit can work.

This community focused system requires lending money to groups of 4 to 8 members that have come together to work jointly on a project, instead of lending money to individuals. This limits greed and envy and encourages people to work and assist each other on shared goals. When a group repays their loan, this money goes back in the community bank and becomes available for the next groups to borrow. An example: a woman's group might borrow money to buy chickens. Selling some of their eggs they get the cash to pay back the loan, making new loans available for others to borrow. The chickens are now owned outright by the group and may be split up or kept collectively. The eggs, and meat, are now at the discretion of the group who owns them to be sold to supplement their income or eaten to supplement their nutrition.

Why do farmers have no money in Madagascar?

In the traditional economy in Madagascar the only access to cash for farmers

is to sell their rice or corn after harvest. Should they need cash at

any other time of the year, to buy seeds or cover medical or other unexpected

expenses they have to turn to moneylenders. Traditionally they will have

to mortgage their future crops promising their harvest as collateral.

Translating this abstract concept into reality: borrowing on "green rice"¯

means that they get a set amount of cash now for their growing fields,

while the lender gets the largest part or the entire rice crop upon harvest.

While they work their fields until harvest to pay back their debt, this

payment, would it be calculated in money, can amount to a 100% to 400%

interest rate. Should the harvest fail, the farmer still owns the promised

amount at the next harvest season, putting in all the sweat equity and

carrying all the risk.

Current microcredit systems offered in Madagascar require a monthly incremental repayment plan. Farmers who have access to cash only once or twice a year after harvest when they sell their crops are not in a position to meet monthly payments and will fall behind with monthly payments by default. Sometimes they have to sell their land or cattle and loose their livelihood, to repay a loan.

Looking at microcredit in a different way

To make a Zahana envisioned microcredit work for farmers in Madagascar,

a system has to be put in place where money or goods can be borrowed

now and paid back in a lump sum after harvest. It requires a system where

the risk is shared with the borrower and if the crops get destroyed by

a cyclone or a pig bought on credit dies, Zahana loses its investment

so the farmer, who was poor to start with, does get not swallowed up

by spiraling deeper into poverty.

The guiding philosophy is that such a microcredit system focuses on community development with all gains ploughed back directly into the community that generated it, and not to pay interest to some outside investor, with the gains leaving the community. The rate of return or the interest rate for this microcredit will be set by the community and can vary on a case-by-case basis.

Strictly speaking this system is a combination of a microcredit and a

seed fund. Zahana will provide the initial seed money for the microcredit,

but all the interest payments returned into the fund stay in the community

making the available funds for the community grow over time. Only time

will tell if Zahana at some point might be able to recuperate the initial

seed money and make it available to other communities.

Strictly speaking this system is a combination of a microcredit and a

seed fund. Zahana will provide the initial seed money for the microcredit,

but all the interest payments returned into the fund stay in the community

making the available funds for the community grow over time. Only time

will tell if Zahana at some point might be able to recuperate the initial

seed money and make it available to other communities.

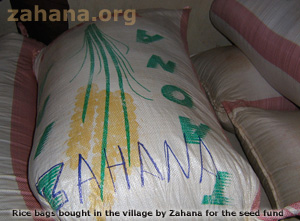

Literally a seed fund: An example

from the field - Creating a rice seed

bank

The international news that rice prices are soaring in early 2008 had a big impact in Madagascar where rice is the food #1 people consume. As stated before, farmers normally sell their rice right after harvest when trucks roam the countryside offering cash for rice. With the lure of fast money, farmers are tempted to sell all their harvest, keeping only the bare minimum they need to eat, not saving enough seed for the next planting season.

To counteract this trend Zahana bought 2 tons of rice in July 2008 in the village of Fiadanana with a dual purpose in mind:

- Have affordable rice to be used for the school food for

the children. [weblink]

- The additional rice will serve as a micro-credit seed fund (literally) where farmers can borrow for the next harvest should they fall short, come planting season next year.

Seeds are traditionally referred to by volume, not weight in Madagascar. A farmer may need 3, 5 or 10 "dabas" to plant a field, depending on its size. A "daba", based on an old tin can the former French colonial power used to sell gasoline in, is roughly the size of a "bucket". (A 'daba' of rice weights around 12 kg or 26 US pounds)

Consequently, farmers will borrow a certain number of 'dabas' of rice to

plant. In return farmers will be asked to give more seed back to Zahana

than they borrowed after harvest to increase the revolving fund in their

seed bank. This innovative community-based system is unknown to farmers,

who in the past had to turn to local moneylenders, who required twice or

three times the amount back of what was loaned to them.

Consequently, farmers will borrow a certain number of 'dabas' of rice to

plant. In return farmers will be asked to give more seed back to Zahana

than they borrowed after harvest to increase the revolving fund in their

seed bank. This innovative community-based system is unknown to farmers,

who in the past had to turn to local moneylenders, who required twice or

three times the amount back of what was loaned to them.

The innovative communal seed bank was spearheaded by Zahana to break this cycle of debt. One tangible result: it became a question of pride for a farmer to pay more seeds back than they have been asked to. They know next planting season somebody else might find themselves in their situation having to borrow from the communal seed bank, so they know they support their own community with their returned rice seeds. (The unhappiness of the traditional moneylender is duly noted.)

Educational Challenges:

Background: It is important to mention here that Madagascar is a cash-based economy only and checks are hardly used at all. Cash for good and services is the norm and e.g. phone and electricity bills in the bigger cities need to be paid in person with cash, after waiting in line, often for hours. There is no ATM for foreigners and credit cards are almost useless, outside setting catering primarily to tourists. Tourist needs to bring the money they plan to spend in cash, and exchange it in banks in major cities. Nobody in the countryside will accept foreign currency. 95% of the Malagasies do not have a bank account and most towns have no bank branches at all.

Microcredit is a great opportunity for adult education. It is a reality that many people in rural villages had little or no formal schooling. Farmers who have barely enough to feed their families and go through cycles of famine almost every year have no concept of the luxury of "saving for a rainy day"¯. This requires acknowledging that intellectual concepts such as percentages and compound interest are foreign to many people and these words have no meaning. Concepts such as "I lend you one daba you give 3 back to me" are the norm.

To make the microcredit work, the teacher, or another educated person in the village needs to be involved that can help translating abstract concepts into and understandable language. Since this is an innovative idea, it needs to be taught, that these funds are available for all, the rates are unusually "low", and come with no stings attached. This is no easy task in a society that has been at the mercy of moneylenders often for generations. This also clearly illustrates the need for adult education, where literacy campaigns go beyond the simple teaching of the ABC, but include applied math and other farming issues in the curriculum.

One of the challenges for outside observers (this also applies for Malagasies who don't live in the respective community) is that in Madagascar each community has their own social organization and structure and come with cultural taboos of "dos and donts" that are unique for their community. Zahana has to learn about each community's specific social structure and cultural protocol and develop a tailor-made solution on a case-to-case basis. An example: while one community may not be allowed to cut down a certain tree protected by a social taboo, a neighboring village might use the same trees as their main source of firewood. This may also extend to crops, or fruits, that can or cannot be planted or eaten.

The ideas of which microcredit project to start first have to be generated by the community and then formally presented to Zahana for evaluation. Zahana then works with them on how best to implement their ideas.

This it traditionally done in community meetings, where groups present intend and ideas that are then discussed at length. Often formal contracts are made in writing and signed by all participants with great ceremony. Certain community members are appointed to oversee the progress and adherence and serve as a liaison to Zahana.

Crops and animals need time to grow. It may take months or years to evaluate, refine and solidify this new venture. Based on the requests made to Zahana by the villagers it is clear that with a small amount of money there are a number of entrepreneurial ventures for them to pursue that can greatly improve their living conditions.

Below: Potatoes - a seed fund project in Fiarenana

This project can also be be found as one of our Zahana GlobalGiving Projects

- A second gardener for the village of Fiadanana - Growing trees for the seed fund

- Zahana has currently a dedicated microcredit project

with GlobalGiving. Click

here to learn more